I thought virgins only wear white?

Moderator: Animal

-

jsdspif

- What the hell's a paragraph?

- Posts: 1292

- Joined: Fri Jan 10, 2020 1:37 pm

I thought virgins only wear white?

I thought white wedding dresses meant the bride was virgin? or is that just not so? my wife was virgin when we married about a week or so after her 18th. Strict roman catholic phillippine upbringining and although it's what evr the aunt that raised her thought virgin is mor valuable but that was no influence. I'm happy to say I met my wife 30 years ago today and it was awesome, we've been exes for 21 years or so because the deal was "if you want to move on, move on" Wehad 7 years, 6 years were great,

Back to white dress , bezos wife , I can't stand that fucker, I forget the percentages but I made 7000 *seven thousand dollars last year) as in less than 10,000 and I paid 1000 in federal taxes , and I see bezos paid reallynothing on his 185 billionor whatever, so if you can explain that go for it. As for her , she has children, so I guess white wedding dress only for virgin isn't a thing? I'll be first to admit I'm jealous of bezos, not because of anything besides the fact he doesn't pay taxes. Why do I pay 1000 on 7000 earned and he pays pretty close to nothing.

Back to white dress , bezos wife , I can't stand that fucker, I forget the percentages but I made 7000 *seven thousand dollars last year) as in less than 10,000 and I paid 1000 in federal taxes , and I see bezos paid reallynothing on his 185 billionor whatever, so if you can explain that go for it. As for her , she has children, so I guess white wedding dress only for virgin isn't a thing? I'll be first to admit I'm jealous of bezos, not because of anything besides the fact he doesn't pay taxes. Why do I pay 1000 on 7000 earned and he pays pretty close to nothing.

- Animal

- The Great Pretender

- Posts: 29717

- Joined: Mon Jan 21, 2019 11:18 pm

Re: I thought virgins only wear white?

the secret to Jeff Bezos' ability to "dodge" income taxes is really very simple. And there is nothing sinister about it.

He is paid a relatively low salary by Amazon. And that salary IS taxed exactly like your $7,000 and everyone else's paycheck stubs. But the bulk of his income is through the appreciate of his stock values. And those values are only taxed when they are sold. And he simply doesn't sell stock every year. In the years that he does sell stock, he pays tremendous amounts of taxes. And Amazon stocks don't pay dividends so there aren't any taxes due on dividend income.

Warren Buffet's wealth is mostly in stocks. But he is known for buying stocks that pay dividends. So even in years that he wouldn't pay taxes on stock gains, he would still have to pay taxes on dividend income.

You can bet that every penny that Jeff Bezos (or anyone else makes) will ultimately be taxed by the IRS. There are loop holes to defer taxes, but not many to eliminate them.

He is paid a relatively low salary by Amazon. And that salary IS taxed exactly like your $7,000 and everyone else's paycheck stubs. But the bulk of his income is through the appreciate of his stock values. And those values are only taxed when they are sold. And he simply doesn't sell stock every year. In the years that he does sell stock, he pays tremendous amounts of taxes. And Amazon stocks don't pay dividends so there aren't any taxes due on dividend income.

Warren Buffet's wealth is mostly in stocks. But he is known for buying stocks that pay dividends. So even in years that he wouldn't pay taxes on stock gains, he would still have to pay taxes on dividend income.

You can bet that every penny that Jeff Bezos (or anyone else makes) will ultimately be taxed by the IRS. There are loop holes to defer taxes, but not many to eliminate them.

- CHEEZY17

- Libertarian House Cat

- Posts: 17045

- Joined: Mon Jan 07, 2019 8:25 pm

Re: I thought virgins only wear white?

These retarded lefties think Bezos and Musk etc. are cashing a billion dollar payroll check every other week.Animal wrote: ↑Mon Jun 30, 2025 12:55 pm the secret to Jeff Bezos' ability to "dodge" income taxes is really very simple. And there is nothing sinister about it.

He is paid a relatively low salary by Amazon. And that salary IS taxed exactly like your $7,000 and everyone else's paycheck stubs. But the bulk of his income is through the appreciate of his stock values. And those values are only taxed when they are sold. And he simply doesn't sell stock every year. In the years that he does sell stock, he pays tremendous amounts of taxes. And Amazon stocks don't pay dividends so there aren't any taxes due on dividend income.

Warren Buffet's wealth is mostly in stocks. But he is known for buying stocks that pay dividends. So even in years that he wouldn't pay taxes on stock gains, he would still have to pay taxes on dividend income.

You can bet that every penny that Jeff Bezos (or anyone else makes) will ultimately be taxed by the IRS. There are loop holes to defer taxes, but not many to eliminate them.

"When governments fear the people, there is liberty. When the people fear the government, there is tyranny."

- Animal

- The Great Pretender

- Posts: 29717

- Joined: Mon Jan 21, 2019 11:18 pm

Re: I thought virgins only wear white?

The one thing that Bezos does that I dont' fully understand is that he borrows against his stock assets. The cash that he gets from the "loan" isn't taxable because it isn't income. So that's how he can drum up the amount of cash it takes to rent Venice. However, I don't understand where he gets the cash to repay the loan. I can see that as a short term solution to generating cash without income taxes, but how long will those lenders wait to be repaid. And the repayment would eventually have to come out of stock sales.CHEEZY17 wrote: ↑Mon Jun 30, 2025 2:43 pmThese retarded lefties think Bezos and Musk etc. are cashing a billion dollar payroll check every other week.Animal wrote: ↑Mon Jun 30, 2025 12:55 pm the secret to Jeff Bezos' ability to "dodge" income taxes is really very simple. And there is nothing sinister about it.

He is paid a relatively low salary by Amazon. And that salary IS taxed exactly like your $7,000 and everyone else's paycheck stubs. But the bulk of his income is through the appreciate of his stock values. And those values are only taxed when they are sold. And he simply doesn't sell stock every year. In the years that he does sell stock, he pays tremendous amounts of taxes. And Amazon stocks don't pay dividends so there aren't any taxes due on dividend income.

Warren Buffet's wealth is mostly in stocks. But he is known for buying stocks that pay dividends. So even in years that he wouldn't pay taxes on stock gains, he would still have to pay taxes on dividend income.

You can bet that every penny that Jeff Bezos (or anyone else makes) will ultimately be taxed by the IRS. There are loop holes to defer taxes, but not many to eliminate them.

- B-Tender

- Christ, get a life already!

- Posts: 4294

- Joined: Sun Jan 06, 2019 9:48 pm

Re: I thought virgins only wear white?

Are you self employed, or a W2 employee? If you are self employed, you didn't pay income tax on that seven thousand, you paid self employment tax of 15.3% for social security and Medicare.jsdspif wrote: ↑Sun Jun 29, 2025 8:21 am I thought white wedding dresses meant the bride was virgin? or is that just not so? my wife was virgin when we married about a week or so after her 18th. Strict roman catholic phillippine upbringining and although it's what evr the aunt that raised her thought virgin is mor valuable but that was no influence. I'm happy to say I met my wife 30 years ago today and it was awesome, we've been exes for 21 years or so because the deal was "if you want to move on, move on" Wehad 7 years, 6 years were great,

Back to white dress , bezos wife , I can't stand that fucker, I forget the percentages but I made 7000 *seven thousand dollars last year) as in less than 10,000 and I paid 1000 in federal taxes , and I see bezos paid reallynothing on his 185 billionor whatever, so if you can explain that go for it. As for her , she has children, so I guess white wedding dress only for virgin isn't a thing? I'll be first to admit I'm jealous of bezos, not because of anything besides the fact he doesn't pay taxes. Why do I pay 1000 on 7000 earned and he pays pretty close to nothing.

- CHEEZY17

- Libertarian House Cat

- Posts: 17045

- Joined: Mon Jan 07, 2019 8:25 pm

Re: I thought virgins only wear white?

So I've mentioned this before: Mrs. Cheezy works for a very successful private investment firm so she sees all of the inner workings of these ultra wealthy folks. She sees the money movements and payments for the new houses, land, boats, cars etc.Animal wrote: ↑Mon Jun 30, 2025 2:56 pmThe one thing that Bezos does that I dont' fully understand is that he borrows against his stock assets. The cash that he gets from the "loan" isn't taxable because it isn't income. So that's how he can drum up the amount of cash it takes to rent Venice. However, I don't understand where he gets the cash to repay the loan. I can see that as a short term solution to generating cash without income taxes, but how long will those lenders wait to be repaid. And the repayment would eventually have to come out of stock sales.CHEEZY17 wrote: ↑Mon Jun 30, 2025 2:43 pmThese retarded lefties think Bezos and Musk etc. are cashing a billion dollar payroll check every other week.Animal wrote: ↑Mon Jun 30, 2025 12:55 pm the secret to Jeff Bezos' ability to "dodge" income taxes is really very simple. And there is nothing sinister about it.

He is paid a relatively low salary by Amazon. And that salary IS taxed exactly like your $7,000 and everyone else's paycheck stubs. But the bulk of his income is through the appreciate of his stock values. And those values are only taxed when they are sold. And he simply doesn't sell stock every year. In the years that he does sell stock, he pays tremendous amounts of taxes. And Amazon stocks don't pay dividends so there aren't any taxes due on dividend income.

Warren Buffet's wealth is mostly in stocks. But he is known for buying stocks that pay dividends. So even in years that he wouldn't pay taxes on stock gains, he would still have to pay taxes on dividend income.

You can bet that every penny that Jeff Bezos (or anyone else makes) will ultimately be taxed by the IRS. There are loop holes to defer taxes, but not many to eliminate them.

Here is what she has told me:

Almost all of these big dollar transactions from those folks are off of a line of credit.

They will put 1 million (or whatever) into a money market earning "X" percent and since they have hundreds of millions of stocks etc. carried by these big houses they have an enormous line of credit secured by their investment portfolio which they can access at a very favorable rate.

They then pay for everything via the line of credit, also at "X" percent, but that percent they pay is LESS than the percent that they EARN via the money in their money market. They get all of the stuff they want and actually MAKE money on it because the money market rate is still higher than the rate their paying for the line of credit.

I'm not entirely sure this is how it works but I think so. The thing I do know is that they use their line of credit almost exclusively.

"When governments fear the people, there is liberty. When the people fear the government, there is tyranny."

- Animal

- The Great Pretender

- Posts: 29717

- Joined: Mon Jan 21, 2019 11:18 pm

Re: I thought virgins only wear white?

Okay. I can understand that. But where do they get the money to pay back the line of credit? At some point it takes some income to pay for any of this.CHEEZY17 wrote: ↑Mon Jun 30, 2025 6:10 pmSo I've mentioned this before: Mrs. Cheezy works for a very successful private investment firm so she sees all of the inner workings of these ultra wealthy folks. She sees the money movements and payments for the new houses, land, boats, cars etc.Animal wrote: ↑Mon Jun 30, 2025 2:56 pmThe one thing that Bezos does that I dont' fully understand is that he borrows against his stock assets. The cash that he gets from the "loan" isn't taxable because it isn't income. So that's how he can drum up the amount of cash it takes to rent Venice. However, I don't understand where he gets the cash to repay the loan. I can see that as a short term solution to generating cash without income taxes, but how long will those lenders wait to be repaid. And the repayment would eventually have to come out of stock sales.CHEEZY17 wrote: ↑Mon Jun 30, 2025 2:43 pmThese retarded lefties think Bezos and Musk etc. are cashing a billion dollar payroll check every other week.Animal wrote: ↑Mon Jun 30, 2025 12:55 pm the secret to Jeff Bezos' ability to "dodge" income taxes is really very simple. And there is nothing sinister about it.

He is paid a relatively low salary by Amazon. And that salary IS taxed exactly like your $7,000 and everyone else's paycheck stubs. But the bulk of his income is through the appreciate of his stock values. And those values are only taxed when they are sold. And he simply doesn't sell stock every year. In the years that he does sell stock, he pays tremendous amounts of taxes. And Amazon stocks don't pay dividends so there aren't any taxes due on dividend income.

Warren Buffet's wealth is mostly in stocks. But he is known for buying stocks that pay dividends. So even in years that he wouldn't pay taxes on stock gains, he would still have to pay taxes on dividend income.

You can bet that every penny that Jeff Bezos (or anyone else makes) will ultimately be taxed by the IRS. There are loop holes to defer taxes, but not many to eliminate them.

Here is what she has told me:

Almost all of these big dollar transactions from those folks are off of a line of credit.

They will put 1 million (or whatever) into a money market earning "X" percent and since they have hundreds of millions of stocks etc. carried by these big houses they have an enormous line of credit secured by their investment portfolio which they can access at a very favorable rate.

They then pay for everything via the line of credit, also at "X" percent, but that percent they pay is LESS than the percent that they EARN via the money in their money market. They get all of the stuff they want and actually MAKE money on it because the money market rate is still higher than the rate their paying for the line of credit.

I'm not entirely sure this is how it works but I think so. The thing I do know is that they use their line of credit almost exclusively.

- CHEEZY17

- Libertarian House Cat

- Posts: 17045

- Joined: Mon Jan 07, 2019 8:25 pm

Re: I thought virgins only wear white?

I believe the payments are taken from the money market account.Animal wrote: ↑Mon Jun 30, 2025 6:33 pmOkay. I can understand that. But where do they get the money to pay back the line of credit? At some point it takes some income to pay for any of this.CHEEZY17 wrote: ↑Mon Jun 30, 2025 6:10 pmSo I've mentioned this before: Mrs. Cheezy works for a very successful private investment firm so she sees all of the inner workings of these ultra wealthy folks. She sees the money movements and payments for the new houses, land, boats, cars etc.Animal wrote: ↑Mon Jun 30, 2025 2:56 pmThe one thing that Bezos does that I dont' fully understand is that he borrows against his stock assets. The cash that he gets from the "loan" isn't taxable because it isn't income. So that's how he can drum up the amount of cash it takes to rent Venice. However, I don't understand where he gets the cash to repay the loan. I can see that as a short term solution to generating cash without income taxes, but how long will those lenders wait to be repaid. And the repayment would eventually have to come out of stock sales.CHEEZY17 wrote: ↑Mon Jun 30, 2025 2:43 pmThese retarded lefties think Bezos and Musk etc. are cashing a billion dollar payroll check every other week.Animal wrote: ↑Mon Jun 30, 2025 12:55 pm the secret to Jeff Bezos' ability to "dodge" income taxes is really very simple. And there is nothing sinister about it.

He is paid a relatively low salary by Amazon. And that salary IS taxed exactly like your $7,000 and everyone else's paycheck stubs. But the bulk of his income is through the appreciate of his stock values. And those values are only taxed when they are sold. And he simply doesn't sell stock every year. In the years that he does sell stock, he pays tremendous amounts of taxes. And Amazon stocks don't pay dividends so there aren't any taxes due on dividend income.

Warren Buffet's wealth is mostly in stocks. But he is known for buying stocks that pay dividends. So even in years that he wouldn't pay taxes on stock gains, he would still have to pay taxes on dividend income.

You can bet that every penny that Jeff Bezos (or anyone else makes) will ultimately be taxed by the IRS. There are loop holes to defer taxes, but not many to eliminate them.

Here is what she has told me:

Almost all of these big dollar transactions from those folks are off of a line of credit.

They will put 1 million (or whatever) into a money market earning "X" percent and since they have hundreds of millions of stocks etc. carried by these big houses they have an enormous line of credit secured by their investment portfolio which they can access at a very favorable rate.

They then pay for everything via the line of credit, also at "X" percent, but that percent they pay is LESS than the percent that they EARN via the money in their money market. They get all of the stuff they want and actually MAKE money on it because the money market rate is still higher than the rate their paying for the line of credit.

I'm not entirely sure this is how it works but I think so. The thing I do know is that they use their line of credit almost exclusively.

Now, if your next question is "But where does the money come from to create the money market account?" That would be from sales, or dividends from their securities thus creating a taxable event (I think?). That's why some of these folks have lines of credit of many many many millions so all they have to do is create the money market account once of a big enough nature.

I admit I'm not an expert here. I am simply trying to piece some things together from what my wife tells me about handling these gigantic accounts.

Maybe Bartender can give some insight into the taxable implications here?

"When governments fear the people, there is liberty. When the people fear the government, there is tyranny."

- Animal

- The Great Pretender

- Posts: 29717

- Joined: Mon Jan 21, 2019 11:18 pm

Re: I thought virgins only wear white?

Well, if you take a big event to pull out some money that is taxable it seems to me that you have defeated the entire purpose. I get that there is something to their madness, otherwise they wouldn't jump through so many hoops. I just don't understand how it works. The only way I could see that it works is like this.CHEEZY17 wrote: ↑Mon Jun 30, 2025 9:43 pmI believe the payments are taken from the money market account.Animal wrote: ↑Mon Jun 30, 2025 6:33 pmOkay. I can understand that. But where do they get the money to pay back the line of credit? At some point it takes some income to pay for any of this.CHEEZY17 wrote: ↑Mon Jun 30, 2025 6:10 pmSo I've mentioned this before: Mrs. Cheezy works for a very successful private investment firm so she sees all of the inner workings of these ultra wealthy folks. She sees the money movements and payments for the new houses, land, boats, cars etc.Animal wrote: ↑Mon Jun 30, 2025 2:56 pmThe one thing that Bezos does that I dont' fully understand is that he borrows against his stock assets. The cash that he gets from the "loan" isn't taxable because it isn't income. So that's how he can drum up the amount of cash it takes to rent Venice. However, I don't understand where he gets the cash to repay the loan. I can see that as a short term solution to generating cash without income taxes, but how long will those lenders wait to be repaid. And the repayment would eventually have to come out of stock sales.CHEEZY17 wrote: ↑Mon Jun 30, 2025 2:43 pmThese retarded lefties think Bezos and Musk etc. are cashing a billion dollar payroll check every other week.Animal wrote: ↑Mon Jun 30, 2025 12:55 pm the secret to Jeff Bezos' ability to "dodge" income taxes is really very simple. And there is nothing sinister about it.

He is paid a relatively low salary by Amazon. And that salary IS taxed exactly like your $7,000 and everyone else's paycheck stubs. But the bulk of his income is through the appreciate of his stock values. And those values are only taxed when they are sold. And he simply doesn't sell stock every year. In the years that he does sell stock, he pays tremendous amounts of taxes. And Amazon stocks don't pay dividends so there aren't any taxes due on dividend income.

Warren Buffet's wealth is mostly in stocks. But he is known for buying stocks that pay dividends. So even in years that he wouldn't pay taxes on stock gains, he would still have to pay taxes on dividend income.

You can bet that every penny that Jeff Bezos (or anyone else makes) will ultimately be taxed by the IRS. There are loop holes to defer taxes, but not many to eliminate them.

Here is what she has told me:

Almost all of these big dollar transactions from those folks are off of a line of credit.

They will put 1 million (or whatever) into a money market earning "X" percent and since they have hundreds of millions of stocks etc. carried by these big houses they have an enormous line of credit secured by their investment portfolio which they can access at a very favorable rate.

They then pay for everything via the line of credit, also at "X" percent, but that percent they pay is LESS than the percent that they EARN via the money in their money market. They get all of the stuff they want and actually MAKE money on it because the money market rate is still higher than the rate their paying for the line of credit.

I'm not entirely sure this is how it works but I think so. The thing I do know is that they use their line of credit almost exclusively.

Now, if your next question is "But where does the money come from to create the money market account?" That would be from sales, or dividends from their securities thus creating a taxable event (I think?). That's why some of these folks have lines of credit of many many many millions so all they have to do is create the money market account once of a big enough nature.

I admit I'm not an expert here. I am simply trying to piece some things together from what my wife tells me about handling these gigantic accounts.

Maybe Bartender can give some insight into the taxable implications here?

You have a gazillion $ in stocks. You use some of that to secure a line of credit for $1 million. Then when that line of credit needs to be repaid you take out another line of credit for $2 million. Use $1 million of it to repay the first line and now you ahve another $1 million in cash. Then when that comes do you take out a $3 million line of credit, etc......

But, at some point you are going to have to pay the piper.

- B-Tender

- Christ, get a life already!

- Posts: 4294

- Joined: Sun Jan 06, 2019 9:48 pm

Re: I thought virgins only wear white?

I don't do returns for billionaires, so there's a lot that I don't know. At some point they have to pay tax on capital gains. The top capital gains rate is 20%, which is a lot lower than 37% for personal income. I would assume their corporation pays for a lot of living expenses.

Edit: There is also a 3.8% net investment tax

Edit: There is also a 3.8% net investment tax

- CHEEZY17

- Libertarian House Cat

- Posts: 17045

- Joined: Mon Jan 07, 2019 8:25 pm

Re: I thought virgins only wear white?

OK, so I just asked Mrs. Cheezy and here is her answer (she's not a financial advisor, she works FOR the financial advisors):

*To pay the line of credit they often have all dividends go directly toward the LOC regardless of tax burden on those dividends

*Sell securities that are at a loss so no taxable income is incurred

*Access liquid monies that are already available in some other type of account

Basically, the LOC allows them the freedom to acquire what they want, when they want and pay it back on their schedule instead of having to liquidate 2 million in securities at once (which in theory could lead to a larger taxable expense then they would incur using the above mentioned ways) to buy "X".

*To pay the line of credit they often have all dividends go directly toward the LOC regardless of tax burden on those dividends

*Sell securities that are at a loss so no taxable income is incurred

*Access liquid monies that are already available in some other type of account

Basically, the LOC allows them the freedom to acquire what they want, when they want and pay it back on their schedule instead of having to liquidate 2 million in securities at once (which in theory could lead to a larger taxable expense then they would incur using the above mentioned ways) to buy "X".

"When governments fear the people, there is liberty. When the people fear the government, there is tyranny."

- CHEEZY17

- Libertarian House Cat

- Posts: 17045

- Joined: Mon Jan 07, 2019 8:25 pm

Re: I thought virgins only wear white?

I don't think this outfit has any billionaires but put it this way, they won't even consider you for a client unless you're at about 10 million at least.B-Tender wrote: ↑Mon Jun 30, 2025 11:08 pm I don't do returns for billionaires, so there's a lot that I don't know. At some point they have to pay tax on capital gains. The top capital gains rate is 20%, which is a lot lower than 37% for personal income. I would assume their corporation pays for a lot of living expenses.

Edit: There is also a 3.8% net investment tax

Mrs. Cheezy routinely handles transactions for clients that are in the 400-600 million net worth dollar range. It's crazy the way these people spend money.

"When governments fear the people, there is liberty. When the people fear the government, there is tyranny."

- Animal

- The Great Pretender

- Posts: 29717

- Joined: Mon Jan 21, 2019 11:18 pm

Re: I thought virgins only wear white?

Two things:CHEEZY17 wrote: ↑Tue Jul 01, 2025 1:43 am OK, so I just asked Mrs. Cheezy and here is her answer (she's not a financial advisor, she works FOR the financial advisors):

*To pay the line of credit they often have all dividends go directly toward the LOC regardless of tax burden on those dividends

*Sell securities that are at a loss so no taxable income is incurred

*Access liquid monies that are already available in some other type of account

Basically, the LOC allows them the freedom to acquire what they want, when they want and pay it back on their schedule instead of having to liquidate 2 million in securities at once (which in theory could lead to a larger taxable expense then they would incur using the above mentioned ways) to buy "X".

Dividends are taxable, so using them to pay the LOC wouldn't be of any advantage.

I would hate to think I had to fund my lifestyle by making losing investments so that when I sold them I had less of the cash than I started with so I wouldn't have to pay taxes on the money that I had already paid taxes on.

And I'm not sure what accessing "liquid monies that are already available" means. Again, that sounds like money that has already been taxed but its now sitting in a savings account.

- CHEEZY17

- Libertarian House Cat

- Posts: 17045

- Joined: Mon Jan 07, 2019 8:25 pm

Re: I thought virgins only wear white?

Yes, the advantage, I suppose, is that there is no money coming out of any account. The LOC is paid by the dividends leaving other accounts in tact.Animal wrote: ↑Tue Jul 01, 2025 12:49 pmTwo things:CHEEZY17 wrote: ↑Tue Jul 01, 2025 1:43 am OK, so I just asked Mrs. Cheezy and here is her answer (she's not a financial advisor, she works FOR the financial advisors):

*To pay the line of credit they often have all dividends go directly toward the LOC regardless of tax burden on those dividends

*Sell securities that are at a loss so no taxable income is incurred

*Access liquid monies that are already available in some other type of account

Basically, the LOC allows them the freedom to acquire what they want, when they want and pay it back on their schedule instead of having to liquidate 2 million in securities at once (which in theory could lead to a larger taxable expense then they would incur using the above mentioned ways) to buy "X".

Dividends are taxable, so using them to pay the LOC wouldn't be of any advantage.

I would hate to think I had to fund my lifestyle by making losing investments so that when I sold them I had less of the cash than I started with so I wouldn't have to pay taxes on the money that I had already paid taxes on.

And I'm not sure what accessing "liquid monies that are already available" means. Again, that sounds like money that has already been taxed but its now sitting in a savings account.

The selling of a losing investment wouldn't be because the person has the intent of buying a bad investment. We all know that no one has a 100% success rate. Anyone that says they do is full of shit. Even multi millionaires with portfolios managed by top tier professionals have losing positions. They would sell those.

"Liquid monies" would simply mean cash available to use for whatever. Yes, basically a savings account.

Again, I'm still trying to piece it all together.

The known variables are that these ultra wealthy folks almost exclusively use lines of credit for their purchases. Why or how that is beneficial to them as opposed to some other way I am still trying work out.

"When governments fear the people, there is liberty. When the people fear the government, there is tyranny."

- Ricrude

- Christ, get a life already!

- Posts: 2995

- Joined: Wed Apr 12, 2023 1:41 pm

- Location: Peeking in your window

- Interests: Drinking, gambling, running around with the wrong crowd, pranks...typical UJ stuff.

- Occupation: In-House Deity

Re: I thought virgins only wear white?

When I win the lottery, I'll let you all know how it's done at the first annual UJRefugees Meeting/Party/BBQ down at Animals whorehouse ranch.CHEEZY17 wrote: ↑Tue Jul 01, 2025 1:11 pmYes, the advantage, I suppose, is that there is no money coming out of any account. The LOC is paid by the dividends leaving other accounts in tact.Animal wrote: ↑Tue Jul 01, 2025 12:49 pmTwo things:CHEEZY17 wrote: ↑Tue Jul 01, 2025 1:43 am OK, so I just asked Mrs. Cheezy and here is her answer (she's not a financial advisor, she works FOR the financial advisors):

*To pay the line of credit they often have all dividends go directly toward the LOC regardless of tax burden on those dividends

*Sell securities that are at a loss so no taxable income is incurred

*Access liquid monies that are already available in some other type of account

Basically, the LOC allows them the freedom to acquire what they want, when they want and pay it back on their schedule instead of having to liquidate 2 million in securities at once (which in theory could lead to a larger taxable expense then they would incur using the above mentioned ways) to buy "X".

Dividends are taxable, so using them to pay the LOC wouldn't be of any advantage.

I would hate to think I had to fund my lifestyle by making losing investments so that when I sold them I had less of the cash than I started with so I wouldn't have to pay taxes on the money that I had already paid taxes on.

And I'm not sure what accessing "liquid monies that are already available" means. Again, that sounds like money that has already been taxed but its now sitting in a savings account.

The selling of a losing investment wouldn't be because the person has the intent of buying a bad investment. We all know that no one has a 100% success rate. Anyone that says they do is full of shit. Even multi millionaires with portfolios managed by top tier professionals have losing positions. They would sell those.

"Liquid monies" would simply mean cash available to use for whatever. Yes, basically a savings account.

Again, I'm still trying to piece it all together.

The known variables are that these ultra wealthy folks almost exclusively use lines of credit for their purchases. Why or how that is beneficial to them as opposed to some other way I am still trying work out.

It is absolutely amazing that some people survive walking out of their homes...fo reelz!

- B-Tender

- Christ, get a life already!

- Posts: 4294

- Joined: Sun Jan 06, 2019 9:48 pm

Re: I thought virgins only wear white?

From an article online:

Step 1: Buy Assets

Wealthy family buys stocks, bonds, real estate, art, or other high-value assets. It strategically holds on to these assets and allows them to grow in value. The family won’t owe income tax on the growth in the assets’ value unless it sells them and makes a profit.

Step 2: Borrow Against Assets

Wealthy family borrows against its assets’ growing value and uses the newly available cash to live off or invest in other assets, like rental properties. The family does NOT owe taxes on its asset-leveraged loans because the government doesn’t tax borrowed money.

Wealthy family uses its untaxed wealth to access significant amounts of untaxed cash to live luxuriously while continuing to grow its wealth, untaxed, indefinitely.

Step 3: Die and Pass Assets Tax Free to Heirs

Wealthy parents or benefactors of the family keep the original appreciated assets until their death, leaving those assets to an heir. Neither the current federal or local tax code require the original asset holders or the heir to pay taxes on the growth in value up to that point. Instead, the tax code wipes out any tax liability for the capital gains by “stepping up” the baseline value of the assets from the original price to their value at the time of the benefactors’ death. This enables the wealthy family’s heirs to altogether avoid taxes on the increased value of stocks, real estate, and valuable artwork.

Step 1: Buy Assets

Wealthy family buys stocks, bonds, real estate, art, or other high-value assets. It strategically holds on to these assets and allows them to grow in value. The family won’t owe income tax on the growth in the assets’ value unless it sells them and makes a profit.

Step 2: Borrow Against Assets

Wealthy family borrows against its assets’ growing value and uses the newly available cash to live off or invest in other assets, like rental properties. The family does NOT owe taxes on its asset-leveraged loans because the government doesn’t tax borrowed money.

Wealthy family uses its untaxed wealth to access significant amounts of untaxed cash to live luxuriously while continuing to grow its wealth, untaxed, indefinitely.

Step 3: Die and Pass Assets Tax Free to Heirs

Wealthy parents or benefactors of the family keep the original appreciated assets until their death, leaving those assets to an heir. Neither the current federal or local tax code require the original asset holders or the heir to pay taxes on the growth in value up to that point. Instead, the tax code wipes out any tax liability for the capital gains by “stepping up” the baseline value of the assets from the original price to their value at the time of the benefactors’ death. This enables the wealthy family’s heirs to altogether avoid taxes on the increased value of stocks, real estate, and valuable artwork.

- Animal

- The Great Pretender

- Posts: 29717

- Joined: Mon Jan 21, 2019 11:18 pm

Re: I thought virgins only wear white?

where is the step that the wealthy family uses to repay the borrowed money in step 2? What kind of bank loans money without wanting to be repaid?B-Tender wrote: ↑Tue Jul 01, 2025 4:19 pm From an article online:

Step 1: Buy Assets

Wealthy family buys stocks, bonds, real estate, art, or other high-value assets. It strategically holds on to these assets and allows them to grow in value. The family won’t owe income tax on the growth in the assets’ value unless it sells them and makes a profit.

Step 2: Borrow Against Assets

Wealthy family borrows against its assets’ growing value and uses the newly available cash to live off or invest in other assets, like rental properties. The family does NOT owe taxes on its asset-leveraged loans because the government doesn’t tax borrowed money.

Wealthy family uses its untaxed wealth to access significant amounts of untaxed cash to live luxuriously while continuing to grow its wealth, untaxed, indefinitely.

Step 3: Die and Pass Assets Tax Free to Heirs

Wealthy parents or benefactors of the family keep the original appreciated assets until their death, leaving those assets to an heir. Neither the current federal or local tax code require the original asset holders or the heir to pay taxes on the growth in value up to that point. Instead, the tax code wipes out any tax liability for the capital gains by “stepping up” the baseline value of the assets from the original price to their value at the time of the benefactors’ death. This enables the wealthy family’s heirs to altogether avoid taxes on the increased value of stocks, real estate, and valuable artwork.

- B-Tender

- Christ, get a life already!

- Posts: 4294

- Joined: Sun Jan 06, 2019 9:48 pm

Re: I thought virgins only wear white?

Once again I'll say I don't know. I think some of the money borrowed is used to service the debt. There will be times when stock loss harvesting is used. I also assume wealthy people receive guaranteed distributions from whatever type of corporate entity they have set up. Guaranteed distributions are taxable, but if the corporation shows a loss, or little to no profit on the bottom line, there won't be as much tax owed.Animal wrote: ↑Tue Jul 01, 2025 4:23 pmwhere is the step that the wealthy family uses to repay the borrowed money in step 2? What kind of bank loans money without wanting to be repaid?B-Tender wrote: ↑Tue Jul 01, 2025 4:19 pm From an article online:

Step 1: Buy Assets

Wealthy family buys stocks, bonds, real estate, art, or other high-value assets. It strategically holds on to these assets and allows them to grow in value. The family won’t owe income tax on the growth in the assets’ value unless it sells them and makes a profit.

Step 2: Borrow Against Assets

Wealthy family borrows against its assets’ growing value and uses the newly available cash to live off or invest in other assets, like rental properties. The family does NOT owe taxes on its asset-leveraged loans because the government doesn’t tax borrowed money.

Wealthy family uses its untaxed wealth to access significant amounts of untaxed cash to live luxuriously while continuing to grow its wealth, untaxed, indefinitely.

Step 3: Die and Pass Assets Tax Free to Heirs

Wealthy parents or benefactors of the family keep the original appreciated assets until their death, leaving those assets to an heir. Neither the current federal or local tax code require the original asset holders or the heir to pay taxes on the growth in value up to that point. Instead, the tax code wipes out any tax liability for the capital gains by “stepping up” the baseline value of the assets from the original price to their value at the time of the benefactors’ death. This enables the wealthy family’s heirs to altogether avoid taxes on the increased value of stocks, real estate, and valuable artwork.

- Animal

- The Great Pretender

- Posts: 29717

- Joined: Mon Jan 21, 2019 11:18 pm

Re: I thought virgins only wear white?

accourding to google.

Between 2006 and 2018:

Bezos' wealth increased by over $127 billion (that's how much is share prices in Amazon increased, which he won't be taxed until he sells them).

He reported $6.5 billion in total income.

He paid $1.4 billion in federal income taxes

So, from 2006 to 2018 he actually sold stock worth $6.5 billion and reported that income to the IRS. On that taxable income he paid the IRS $1.4 billion in income taxes. That's 21.53% income tax which should be right because it would be taxed at capital gains rate.

Its a little flippant of people to say that Bezos pays no income taxes. $1.4 billion? and from that he was left with $5.1 billion to spend. I'm not even sure a person could spend $5.1 billion in 12 years. That would be spending around $415 million a year.

Between 2006 and 2018:

Bezos' wealth increased by over $127 billion (that's how much is share prices in Amazon increased, which he won't be taxed until he sells them).

He reported $6.5 billion in total income.

He paid $1.4 billion in federal income taxes

So, from 2006 to 2018 he actually sold stock worth $6.5 billion and reported that income to the IRS. On that taxable income he paid the IRS $1.4 billion in income taxes. That's 21.53% income tax which should be right because it would be taxed at capital gains rate.

Its a little flippant of people to say that Bezos pays no income taxes. $1.4 billion? and from that he was left with $5.1 billion to spend. I'm not even sure a person could spend $5.1 billion in 12 years. That would be spending around $415 million a year.

- B-Tender

- Christ, get a life already!

- Posts: 4294

- Joined: Sun Jan 06, 2019 9:48 pm

Re: I thought virgins only wear white?

The idea that wealthy people don't pay any tax is naive. What I see mostly is people complaining that the percentage paid is lower than some middle class pay.Animal wrote: ↑Tue Jul 01, 2025 5:08 pm accourding to google.

Between 2006 and 2018:

Bezos' wealth increased by over $127 billion (that's how much is share prices in Amazon increased, which he won't be taxed until he sells them).

He reported $6.5 billion in total income.

He paid $1.4 billion in federal income taxes

So, from 2006 to 2018 he actually sold stock worth $6.5 billion and reported that income to the IRS. On that taxable income he paid the IRS $1.4 billion in income taxes. That's 21.53% income tax which should be right because it would be taxed at capital gains rate.

Its a little flippant of people to say that Bezos pays no income taxes. $1.4 billion? and from that he was left with $5.1 billion to spend. I'm not even sure a person could spend $5.1 billion in 12 years. That would be spending around $415 million a year.

- Animal

- The Great Pretender

- Posts: 29717

- Joined: Mon Jan 21, 2019 11:18 pm

Re: I thought virgins only wear white?

Well, if you make over $50,000, then you are in the 22% bracket. Which could easily put you paying a higher percentage than someone that has managed to get every penny of their income from asset appreciation (and paying capital gains rates) rather than salary or other standard income streams. But, aside from Jeff Bezos, there just aren't that many people that get most every bit of their income from stock appreciation. I guess you could make a living buying expensive land parcels and hang on to them for asset appreciation and get income through capital gains. But those examples are not very easy to pull off. Capital gains rates are set up so that people can actually be incentivized to own assets for longer periods of time.B-Tender wrote: ↑Tue Jul 01, 2025 7:31 pmThe idea that wealthy people don't pay any tax is naive. What I see mostly is people complaining that the percentage paid is lower than some middle class pay.Animal wrote: ↑Tue Jul 01, 2025 5:08 pm accourding to google.

Between 2006 and 2018:

Bezos' wealth increased by over $127 billion (that's how much is share prices in Amazon increased, which he won't be taxed until he sells them).

He reported $6.5 billion in total income.

He paid $1.4 billion in federal income taxes

So, from 2006 to 2018 he actually sold stock worth $6.5 billion and reported that income to the IRS. On that taxable income he paid the IRS $1.4 billion in income taxes. That's 21.53% income tax which should be right because it would be taxed at capital gains rate.

Its a little flippant of people to say that Bezos pays no income taxes. $1.4 billion? and from that he was left with $5.1 billion to spend. I'm not even sure a person could spend $5.1 billion in 12 years. That would be spending around $415 million a year.

- B-Tender

- Christ, get a life already!

- Posts: 4294

- Joined: Sun Jan 06, 2019 9:48 pm

Re: I thought virgins only wear white?

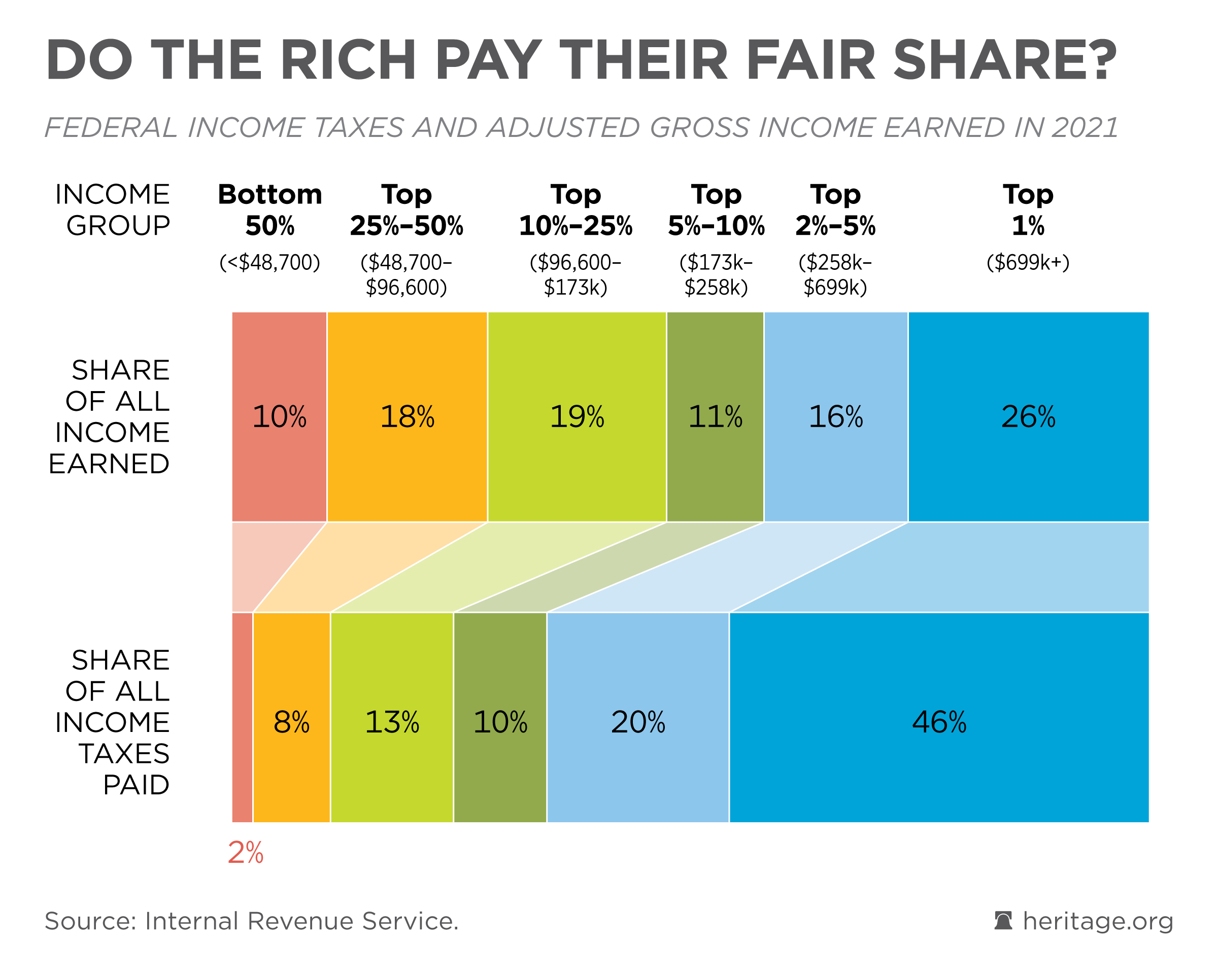

100%. High income earners pay a lot in taxes.Animal wrote: ↑Tue Jul 01, 2025 9:04 pmWell, if you make over $50,000, then you are in the 22% bracket. Which could easily put you paying a higher percentage than someone that has managed to get every penny of their income from asset appreciation (and paying capital gains rates) rather than salary or other standard income streams. But, aside from Jeff Bezos, there just aren't that many people that get most every bit of their income from stock appreciation. I guess you could make a living buying expensive land parcels and hang on to them for asset appreciation and get income through capital gains. But those examples are not very easy to pull off. Capital gains rates are set up so that people can actually be incentivized to own assets for longer periods of time.B-Tender wrote: ↑Tue Jul 01, 2025 7:31 pmThe idea that wealthy people don't pay any tax is naive. What I see mostly is people complaining that the percentage paid is lower than some middle class pay.Animal wrote: ↑Tue Jul 01, 2025 5:08 pm accourding to google.

Between 2006 and 2018:

Bezos' wealth increased by over $127 billion (that's how much is share prices in Amazon increased, which he won't be taxed until he sells them).

He reported $6.5 billion in total income.

He paid $1.4 billion in federal income taxes

So, from 2006 to 2018 he actually sold stock worth $6.5 billion and reported that income to the IRS. On that taxable income he paid the IRS $1.4 billion in income taxes. That's 21.53% income tax which should be right because it would be taxed at capital gains rate.

Its a little flippant of people to say that Bezos pays no income taxes. $1.4 billion? and from that he was left with $5.1 billion to spend. I'm not even sure a person could spend $5.1 billion in 12 years. That would be spending around $415 million a year.

- CHEEZY17

- Libertarian House Cat

- Posts: 17045

- Joined: Mon Jan 07, 2019 8:25 pm

Re: I thought virgins only wear white?

Here is what Grok AI says on the matter:

"Wealthy people use lines of credit instead of paying cash for several strategic reasons:

Liquidity Preservation: Keeping cash available allows them to seize investment opportunities, cover unexpected expenses, or manage cash flow without liquidating assets, which could incur taxes or losses.

Leverage for Investments: Borrowing at a lower interest rate to invest in opportunities with higher returns (e.g., real estate, businesses, or stocks) can amplify wealth. This is often called "using other people's money."

Tax Advantages: Interest on certain loans (e.g., mortgages or business loans) may be tax-deductible, reducing the overall cost of borrowing. Additionally, holding appreciated assets avoids capital gains taxes.

Asset Protection: Using credit instead of selling assets can protect wealth from market fluctuations or forced sales, especially for illiquid assets like real estate or private equity.

Convenience and Flexibility: Lines of credit provide quick access to funds without the need to liquidate investments or navigate complex financial transactions, offering flexibility for large purchases or projects.

Low Interest Rates: Wealthy individuals often secure lines of credit with favorable terms due to their strong credit profiles or relationships with financial institutions. If the interest rate is low, borrowing can be cheaper than the opportunity cost of tying up cash or selling assets at a loss.

In summary, using lines of credit allows wealthy individuals to optimize cash flow, leverage investments, gain tax benefits, protect assets, and maintain flexibility, all while taking advantage of low-cost borrowing."

"Wealthy people use lines of credit instead of paying cash for several strategic reasons:

Liquidity Preservation: Keeping cash available allows them to seize investment opportunities, cover unexpected expenses, or manage cash flow without liquidating assets, which could incur taxes or losses.

Leverage for Investments: Borrowing at a lower interest rate to invest in opportunities with higher returns (e.g., real estate, businesses, or stocks) can amplify wealth. This is often called "using other people's money."

Tax Advantages: Interest on certain loans (e.g., mortgages or business loans) may be tax-deductible, reducing the overall cost of borrowing. Additionally, holding appreciated assets avoids capital gains taxes.

Asset Protection: Using credit instead of selling assets can protect wealth from market fluctuations or forced sales, especially for illiquid assets like real estate or private equity.

Convenience and Flexibility: Lines of credit provide quick access to funds without the need to liquidate investments or navigate complex financial transactions, offering flexibility for large purchases or projects.

Low Interest Rates: Wealthy individuals often secure lines of credit with favorable terms due to their strong credit profiles or relationships with financial institutions. If the interest rate is low, borrowing can be cheaper than the opportunity cost of tying up cash or selling assets at a loss.

In summary, using lines of credit allows wealthy individuals to optimize cash flow, leverage investments, gain tax benefits, protect assets, and maintain flexibility, all while taking advantage of low-cost borrowing."

Last edited by CHEEZY17 on Wed Jul 02, 2025 1:25 am, edited 1 time in total.

"When governments fear the people, there is liberty. When the people fear the government, there is tyranny."

- CHEEZY17

- Libertarian House Cat

- Posts: 17045

- Joined: Mon Jan 07, 2019 8:25 pm

Re: I thought virgins only wear white?

tHey dOnT pAy thErE FaiR sHare!!!!111B-Tender wrote: ↑Tue Jul 01, 2025 9:25 pm100%. High income earners pay a lot in taxes.Animal wrote: ↑Tue Jul 01, 2025 9:04 pmWell, if you make over $50,000, then you are in the 22% bracket. Which could easily put you paying a higher percentage than someone that has managed to get every penny of their income from asset appreciation (and paying capital gains rates) rather than salary or other standard income streams. But, aside from Jeff Bezos, there just aren't that many people that get most every bit of their income from stock appreciation. I guess you could make a living buying expensive land parcels and hang on to them for asset appreciation and get income through capital gains. But those examples are not very easy to pull off. Capital gains rates are set up so that people can actually be incentivized to own assets for longer periods of time.B-Tender wrote: ↑Tue Jul 01, 2025 7:31 pmThe idea that wealthy people don't pay any tax is naive. What I see mostly is people complaining that the percentage paid is lower than some middle class pay.Animal wrote: ↑Tue Jul 01, 2025 5:08 pm accourding to google.

Between 2006 and 2018:

Bezos' wealth increased by over $127 billion (that's how much is share prices in Amazon increased, which he won't be taxed until he sells them).

He reported $6.5 billion in total income.

He paid $1.4 billion in federal income taxes

So, from 2006 to 2018 he actually sold stock worth $6.5 billion and reported that income to the IRS. On that taxable income he paid the IRS $1.4 billion in income taxes. That's 21.53% income tax which should be right because it would be taxed at capital gains rate.

Its a little flippant of people to say that Bezos pays no income taxes. $1.4 billion? and from that he was left with $5.1 billion to spend. I'm not even sure a person could spend $5.1 billion in 12 years. That would be spending around $415 million a year.

"When governments fear the people, there is liberty. When the people fear the government, there is tyranny."

- Animal

- The Great Pretender

- Posts: 29717

- Joined: Mon Jan 21, 2019 11:18 pm

Re: I thought virgins only wear white?

where do they get the money to repay the loan?CHEEZY17 wrote: ↑Wed Jul 02, 2025 1:17 am Here is what Grok AI says on the matter:

"Wealthy people use lines of credit instead of paying cash for several strategic reasons:

Liquidity Preservation: Keeping cash available allows them to seize investment opportunities, cover unexpected expenses, or manage cash flow without liquidating assets, which could incur taxes or losses.

Leverage for Investments: Borrowing at a lower interest rate to invest in opportunities with higher returns (e.g., real estate, businesses, or stocks) can amplify wealth. This is often called "using other people's money."

Tax Advantages: Interest on certain loans (e.g., mortgages or business loans) may be tax-deductible, reducing the overall cost of borrowing. Additionally, holding appreciated assets avoids capital gains taxes.

Asset Protection: Using credit instead of selling assets can protect wealth from market fluctuations or forced sales, especially for illiquid assets like real estate or private equity.

Convenience and Flexibility: Lines of credit provide quick access to funds without the need to liquidate investments or navigate complex financial transactions, offering flexibility for large purchases or projects.

Low Interest Rates: Wealthy individuals often secure lines of credit with favorable terms due to their strong credit profiles or relationships with financial institutions. If the interest rate is low, borrowing can be cheaper than the opportunity cost of tying up cash or selling assets at a loss.

In summary, using lines of credit allows wealthy individuals to optimize cash flow, leverage investments, gain tax benefits, protect assets, and maintain flexibility, all while taking advantage of low-cost borrowing."